A couple years ago (has it really been that long?) I completed my quest to build the entire 199-card 1993 Finest Refractors baseball card set. Building the set that killed Junk Wax was an all-consuming obsession, one that saw me try to process every bit of information that could be extracted from fading message boards, derelict websites, and countless anecdotes ranging from credible eyewitness accounts to outright myths.

What emerged from this project was more than just a complete set of cards. It was a framework for unpacking the actual ground truth behind the most pivotal baseball cards of the last 50 years, an attempt to separate signal from noise around a set built as much on legend as on cardboard.

This is the second annual installment of my effort to map where the set stands in today’s market, not just which cards are hard to find, but how this difficulty has shifted with time. The hobby landscape is constantly evolving, and the names that tormented collectors a couple decades ago aren’t necessarily the same ones causing headaches in 2025. I’m tracking those shifts, identifying which Refractors have become genuinely scarce versus merely expensive, and documenting how changing collector priorities have reshaped the hunt itself.

WHAT I SAW IN 2025

While I crossed off the final name from my set building checklist in 2024, I did manage to add something new to my own Refractor collection during 2025. Joining my set this year was an unopened pack.

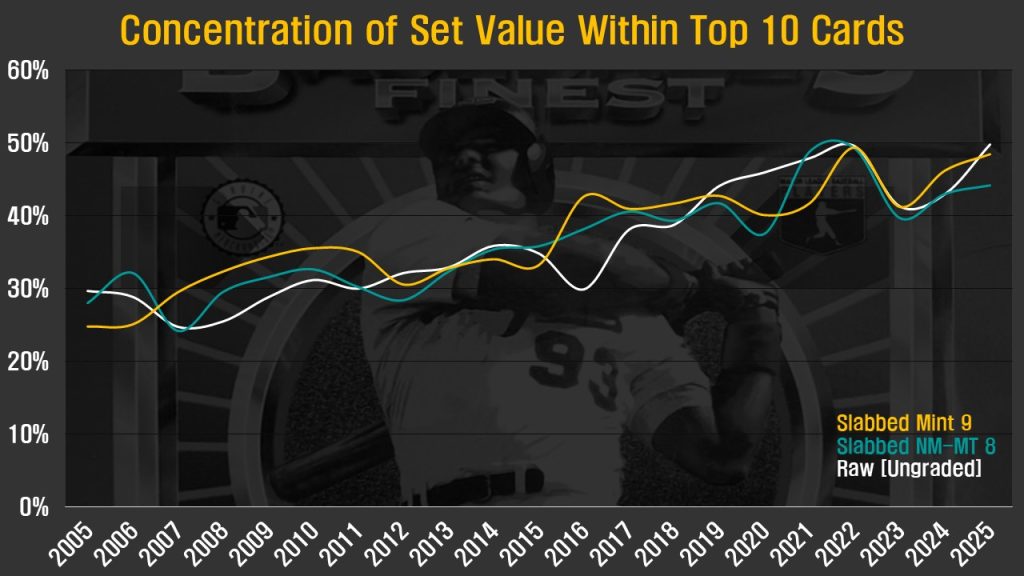

A recurring theme this year was continued concentration of collector interest among the bigger names names in the Refractor set. The ten most valuable cards commanded half the overall value of the set, despite representing only 5 percent of the 199-card checklist. This wasn’t accomplished so much through soaring prices, but rather consistently lower prices for common cards.

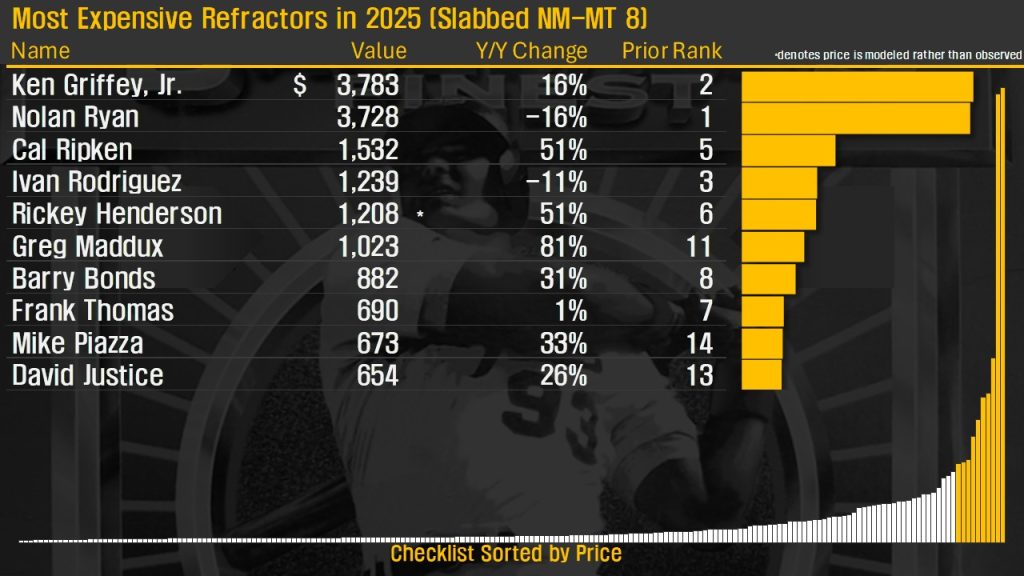

As always, there were a good number of transactions that caught my eye. A full set consisting of graded 9s and 10s was sold in May for $61,000 by Heritage Auctions. I saw a Roberto Kelly Refractor sell on eBay, a notable card because it was slabbed as a PSA 2, making it perhaps the lowest grade Refractor out there. Set collectors may have been asleep when an Orestes Destrade card sold for less than $30, a price not seen in a decade for one of the set’s more frustrating commons. Availability of Jimmy Key Refractors continued to normalize after more than a decade as one of the toughest names in the set. While they still command above average prices on most occasions, I saw a raw one sell for less than $20 at one point. 11 different names were seen changing hands at prices of $10 or less in 2025, largely in midgrade slabs. At the other end of the spectrum, 89 PSA 10 cards changed hands with a Gem Mint Ken Griffey, Jr. selling in March for $20,400.

Two players, Ryne Sandberg and Mike Greenwell, died in 2025. Add to this list Rickey Henderson who passed just days before the beginning of the year and you get quite a group of missing people from the checklist. There are now 184 players left alive from the checklist, a number that seems way too low given the relative recency of the cards’ issuance.

REFRACTOR AVAILABILITY

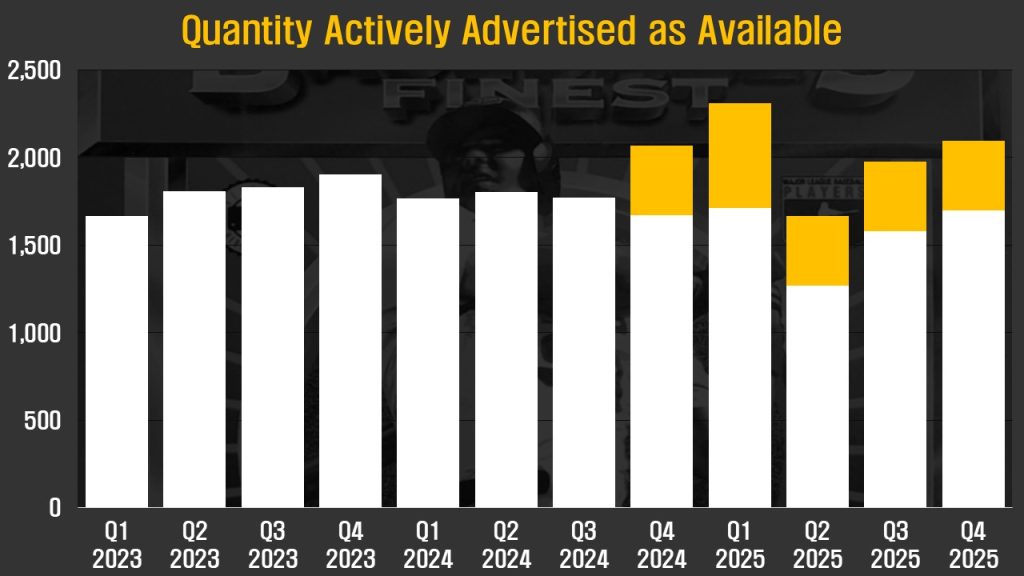

At any given moment, how many Refractors are available for purchase? One of the metrics I track is the total number of Refractors advertised for sale across multiple online platforms. A typical period sees about 1,900 Refractors available at any given moment, subject to a fluctuation of about ±200 cards in any given quarterly measurement period.

There were 2,094 Refractors available at the conclusion of 2025, a figure right at the high end of that historical range but almost unchanged from last year’s census of 2,067 available cards. Of those available at 2025 yearend, 398 were only available as part of a pair of complete sets that have been on the market for quite some time. An advertised partial set lurks just below the surface, representing almost another 200 cards in this survey of available cards. Absent this iceberg of cards being marketed as a group, overall availability of individual cards is right in line with historical averages.

A recurring limitation of this view of availability is that it only reflects cards currently advertised regardless of sellers’ asking price. Ken Caminiti hit more than 200 home runs in his career, but a Caminiti Refractor with an asking price of $200 is just as good as one not actually for sale. The market just will not clear at that price. For the purpose of discovering what is available at prices collectors are willing to actually transact at, “available” cards like this simply provide zero value.

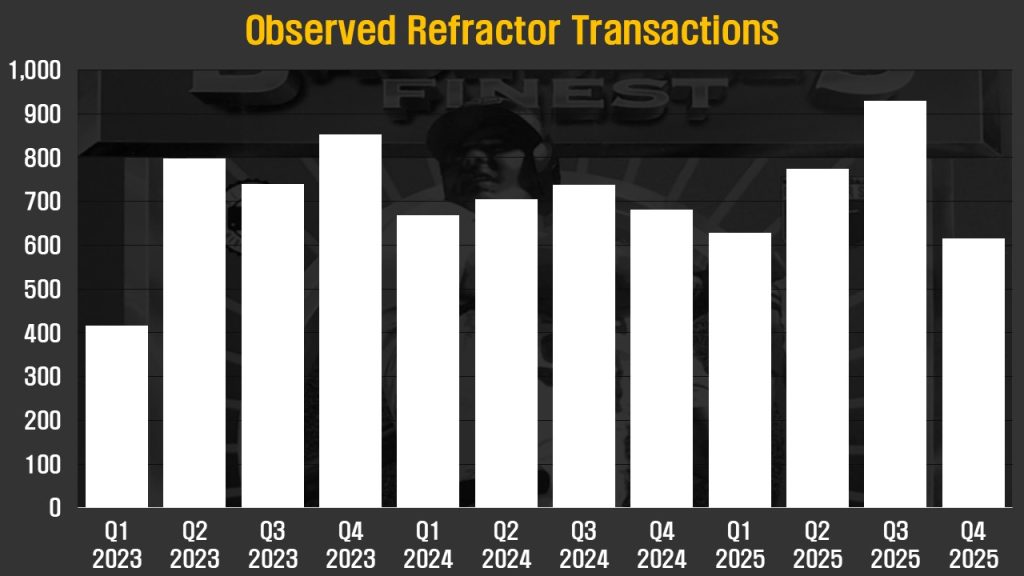

To find this sort of information, out attention turns to the study of completed transactions. I observed 2,950 Refractors changing hands in 2025 and even managed to add data on nearly 1,000 additional transactions from earlier years. The 2025 transaction count is up 6% from the prior year and in line with the sort of numbers seen for the last several years.

In aggregate, there is nothing to see here. But what about breaking down availability to the more granular level of individual cards within the set? Rumors, myths, and frustrated set and player collectors abound in this area.

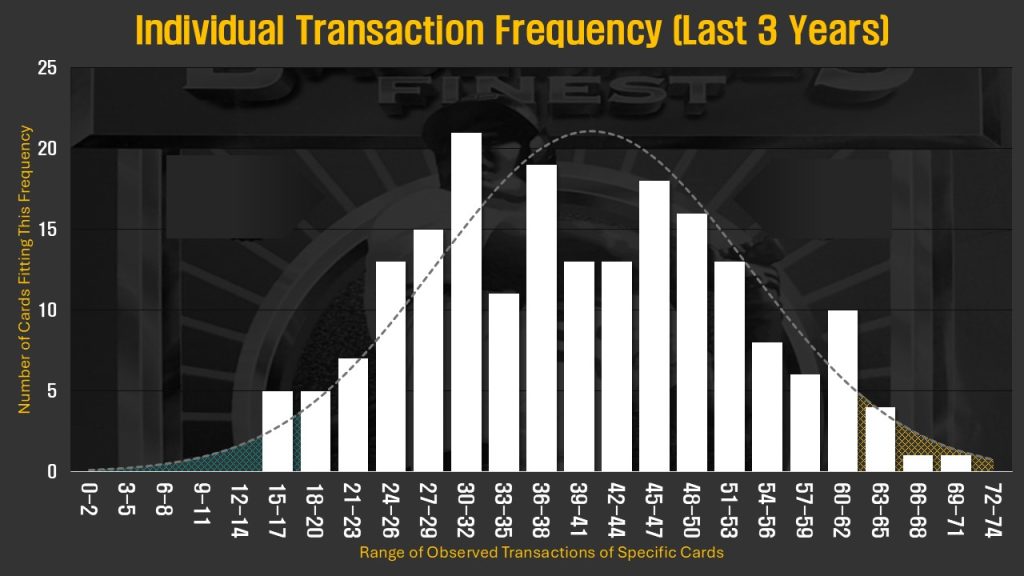

Appearing below is a histogram depicting how often each card in the checklist was observed being bought or sold over the past three years. The X-Axis represents a range of transaction frequency recorded over this period and the Y-Axis displays the number of names in the checklist falling within each of these ranges. The average Refractor crossed the market 40 times in this span, representing collectors getting a shot at specific cards on average once every 27 days. The median was pretty close to this reading, coming in at 39 transactions over three years (once every 28 days).

Mean and median were once again pretty closely aligned in this distribution, but that is not to say certain cards did not prove to be outliers. Some were simply easier to find than others.

Moises Alou and Ray Lankford were the most active cards in 2025 while cards of Edgar Martinez were observed selling 70 times in the past 3 years. In contrast, the list of least seen Refractors reads like a Greatest Hits collection of cards that have frustrated this set’s collector base for years. Harold Baines and Howard Johnson were the least seen Refractors of 2025. Ivan Rodriguez remained the hardest to find of the last 3 years, though there was a 50% increase compared to my 2024 census in the number of transactions involving Pudge. Despite a similarly sized increase in transactions following his death, Rickey Henderson cards remain the least seen over the past three years with a card coming to market on average once every 64 days. Perennial scarcities like Orel Hershiser joined Rickey near the top of the list. The good news for collectors is that each and every one of these challengign cards was seen more often in the last year, indicating at least a greater willingness of collectors to make their toughest cards available to others.

There remains an ebb and flow to the availability of cards. At the end of last year Duane Ward and Reggie Sanders had gone the longest without a recorded sale. The Duane Ward drought concluded just one day later and a Sanders card was purchased on January 11 after having gone 133 days without a transaction. The numbers are less dramatic at the end of 2025 after a set break in December. There are 140 names that are currently tied for having gone the longest without a sale with their most recent transaction having taken place just 23 days ago.

REGISTRY TRENDS

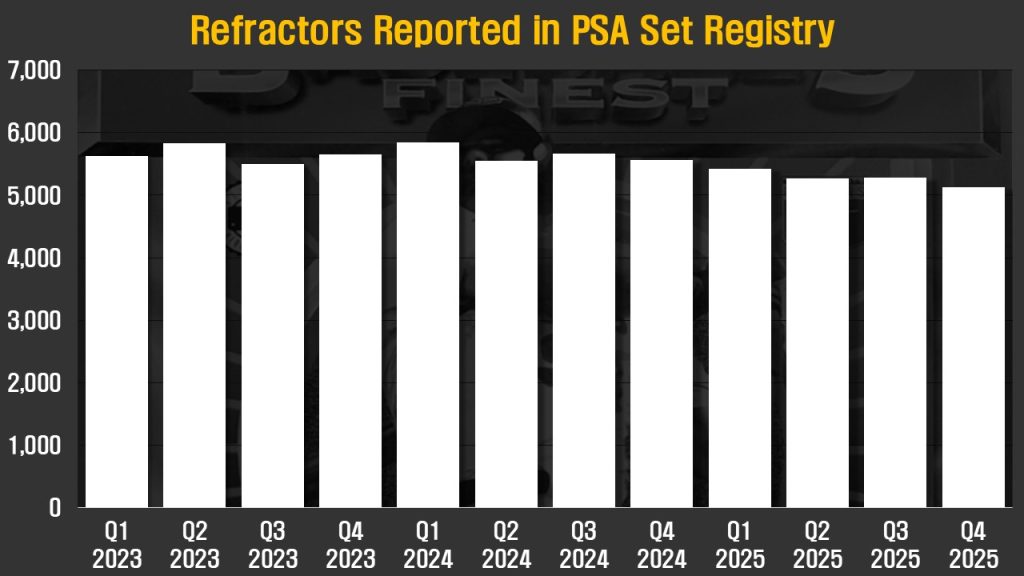

Another way of gauging availability trends is to look at the opposite of advertised and sold cards; the absence of transactions that represent the number of cards locked away in long term collections. While no publicly available figure provides a direct insight into how many cards will be unavailable for an extended period, there exists a somewhat reasonable proxy. Multiple refractor collections are recorded within the PSA Set Registry. Many registry participants have been involved with building the set for extended periods. Combined with the fact that the registry does not allow for duplication of individual serial numbers, this census presents a relatively clean data set and likely reflects a general correlation with the number of cards unlikely to be offered in the near term.

The total refractor registry population declined 8% from the year ago period, trending downward a bit faster than the low-single digit volatility of recent years. A portion of this can be attributed to the sale of one of the 16 complete sets that were in last year’s total, though the bulk of the change appears to originate in a thinning out of the contents of the 30+ partial sets being tracked. Not only did these sets that are supposedly aspiring towards completion not add cards on balance, they sold cards. Registry sets contain 18% of all refractors graded by PSA, a decline of 2 percentage points from the prior year.

THIRD PARTY GRADING TRENDS

Refractors and modern third party grading services gained initial popularity around the same time. The creation of PSA’s Set Registry added a competitive element to collecting and created an incentive to slab as many of these modern cards as possible. The result was a large portion of the Refractor population being graded and logged into third party grading population databases.

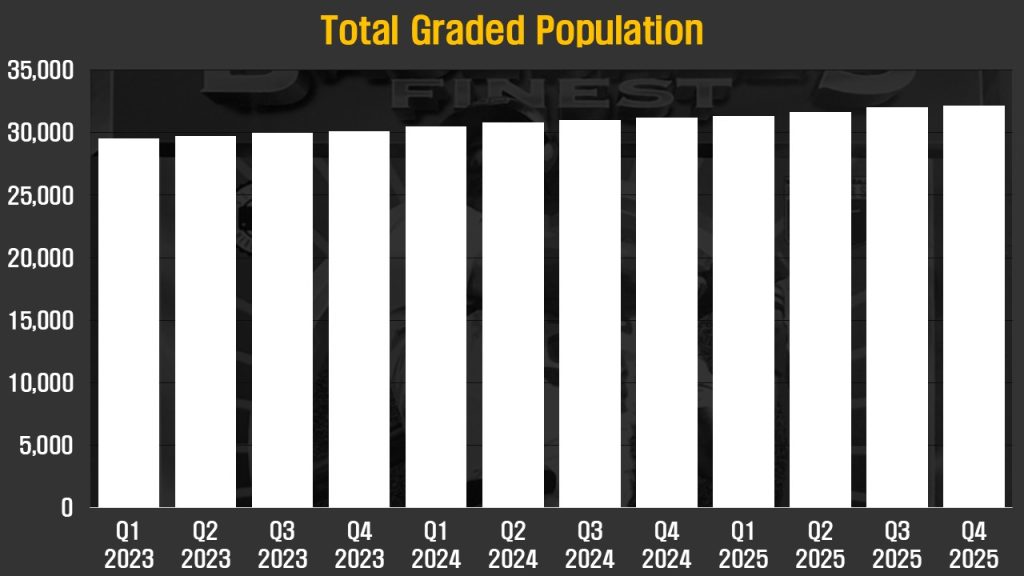

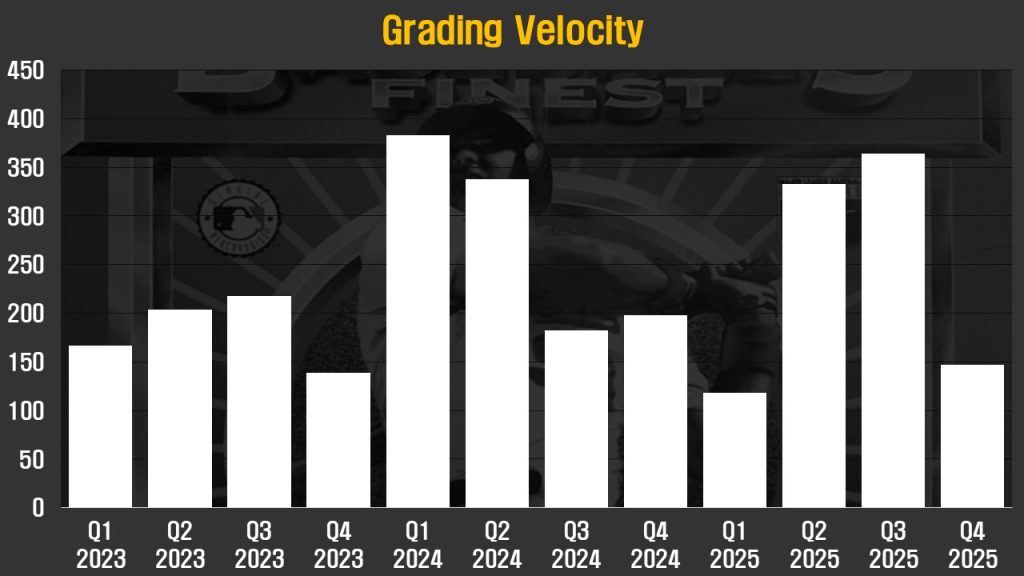

This chart exemplifies what I find so interesting about the grading trends of these cards: Despite massive increases in grading throughout the hobby the number of newly slabbed Refractors remains small. PSA was grading 2 million cards per year in 2019, hit 15 million in 2024, and appears to have hit the 20 million mark in 2025. The overall number of new slabs is another 30% larger when the other major grading firms are included. And yet, even with so many cards being locked away in plastic, the number of newly slabbed ’93 Refractors grew by just 962 cards (+3%) in 2025.

Total growth in this population has been 13% over the last 5 years, a period that saw more the majority of all graded cards spring into existence. This all but screams that there are not massive piles of unknown Refractors waiting to flood the hobby. What’s out there is pretty much already out there. Looking at the quarterly cadence of newly graded Refractors, the most recent year was nothing out of the ordinary. It was another year of 3% growth, in line with recent trends.

That doesn’t mean things didn’t get exciting. A handful of newly submitted Refractors came back with Gem Mint 10 designations. The population of Gem Mint cards increased by 3 to 2,671 in the last 12 months. Newly added to the pop report were flawless cards of Don Mattingly, Doc Gooden, and Brian Harper. The Harper is a noted condition rarity at the top end of the scale and now boasts a total population of 3 perfect copies known to collectors. For those chasing a perfect set (Hi Nat!) the emergence of the Harper card is a very big deal.

With so few Refractors having been graded over the course of the year there was very little change in market share among the major grading services. PSA continued to hold 90.4% with almost the entirety of the balance accounted for by Beckett (5.3%) and SGC (4.1%).

The skew towards PSA increased in 2025 with the leading grading service garnering 93.9% of new Refractor submissions. SGC captured 4.5% of submissions and CGC accounted for 1.1%. Beckett, recently dragged through an epic corporate meltdown, saw its share of new Refractors fall to 0.5%. I expect this trend to continue in the new year following PSA’s acquisitions of SGC and Beckett. SGC’s services took a hit following the purchase and Beckett was pretty much already dead to the world of baseball cards by the time PSA became its third owner inside of a year. PSA has long been the dominant force in grading this set and nothing appears likely to change that in the near future.

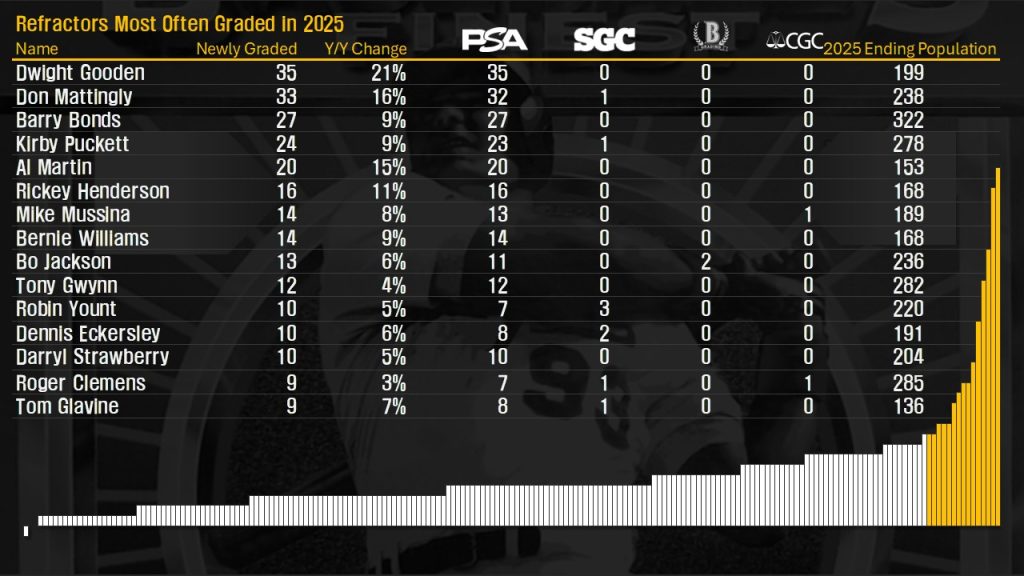

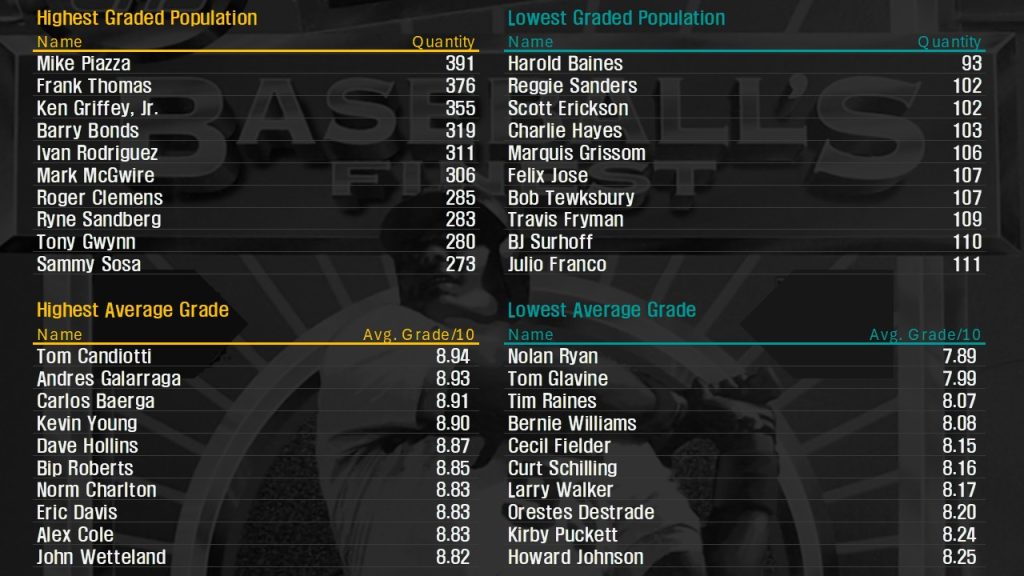

Not every card saw equal numbers submitted for grading. 10 Cards had at least a dozen examples go through PSA in last 12 months, with notable expansions in the populations of several popular players. The generally tough Dwight Gooden card led the pack in 2025 with 35 newly graded examples, a figure that includes the Gem Mint 10 example highlighted earlier. The same applies for Don Mattingly with 33 newly graded cards. Almost every card in the set experienced a net gain in graded population, though by my count 11 cards had at least 1 serial number removed from their pop reports. Mike Piazza (pop 391, +5y/y) and Harold Baines (pop 93, +3y/y) remain the most and least graded names in the checklist. Ivan Rodriguez, who experienced more than 80 newly graded examples in 2024, experienced a population increase of just 4 in the recently concluded period.

Given such minor changes in the overall population of graded Refractors there was little variance in the average reported grades in the checklist. The typical ’93 Finest Refractor continues to exhibit a numerical grade of just above 8.5 (NM-MT+). Newly graded cards in 2025 prompted a minor reordering of the highest average grade with Tom Candiotti (average grade 8.94) surpassing Andres Galarraga (8.93). Nolan Ryan remains one of the two condition sensitive names that average less than a NM-MT 8 in the pop report. The other is Tom Glavine, who’s average grade slipped from 8.13 to 7.99 amid some less than perfect new grades.

REFRACTOR PRICING TRENDS IN 2025

Realistic price guides did not exist when I began trying to complete this set, leaving me searching for some way to make sense of the wildly variable asking prices from sellers across platforms. Did a high price tag indicate a delusional seller or was I being presented with a fair offer to acquire a truly hard to obtain item for my collection? I honestly couldn’t be sure. To address this, I sought out every scrap of transaction data that I could, cleaning data and eventually pulling together more than 40,000 records to build a realistic guide. I developed a pricing model taking into account transaction volume and condition grades and continue to expand it at every opportunity.

This year I captured nearly 3,000 transactions and added another 994 for prior years from a new source. Total dollar volume of Refractor sales was $678,813 in 2025, an increase of 44% over the prior year. An increase in high dollar Gem Mint 10 slabs boosted the nominal amount, as did the sale of a high grade complete set in May.

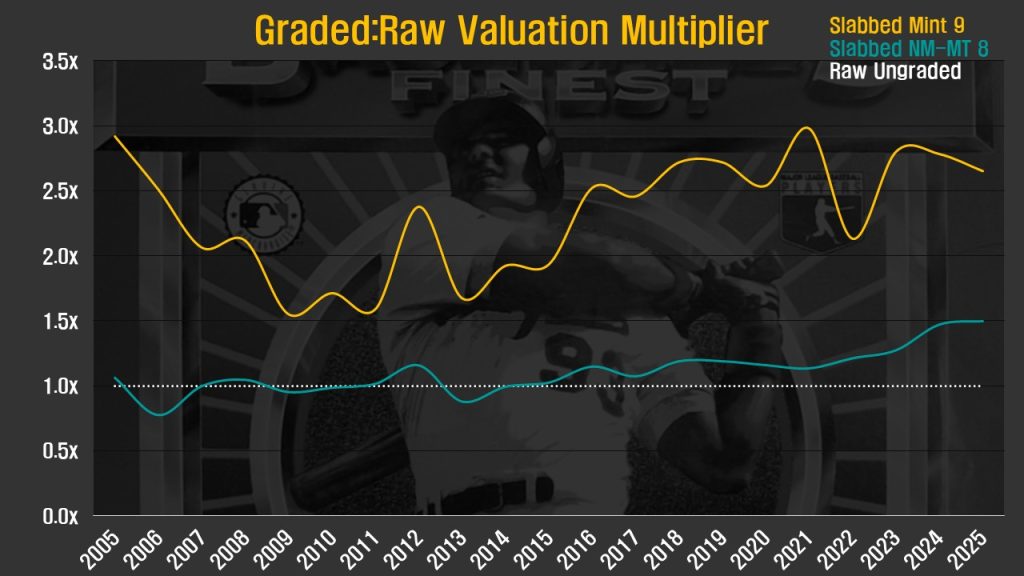

The high percentage of Refractors residing in slabs presents interesting market dynamics. What sort of premium exists for graded examples over their raw counterparts, and how does this behavior play out between the most commonly encountered grades?

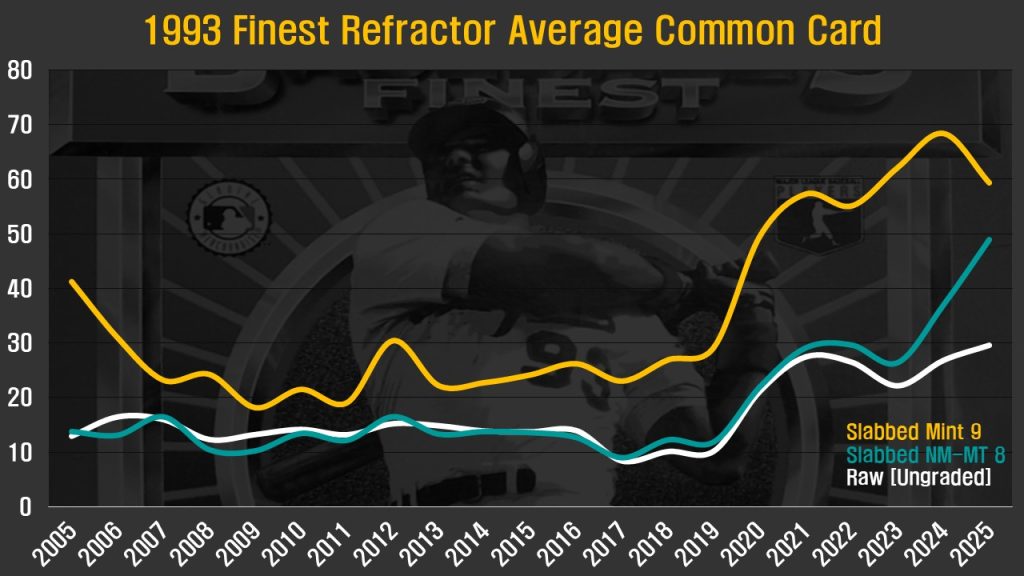

For much of the past 20 years ungraded cards changed hands at prices equal to the same cards with NM-MT slabs bearing numerical grades of 8 out of 10. That relationship has shifted in recent years with Slabbed NM-MT 8 cards commanding an average 50% premium to their ungraded counterparts. Cards graded Mint 9 ended the year with an average premium of 2.65x over ungraded examples, in line with the five year average of 2.67x.

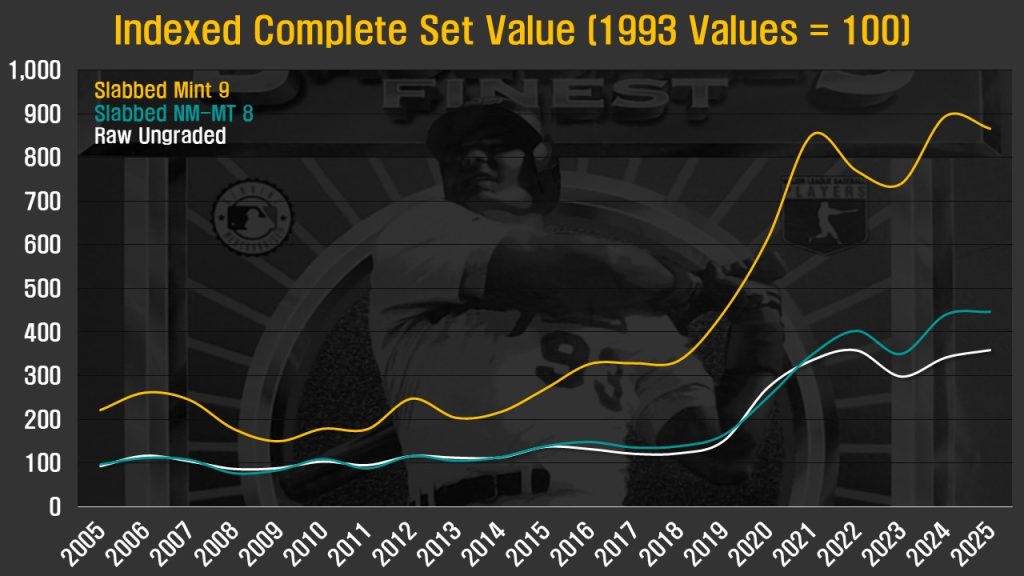

These condition premiums are more apparent when viewed through the lens of valuations of a complete set. Prices are charted below on a scale indexed to the first Beckett pricing of the Refractor issue in 1993. Prices for raw cards increased by 5% in 2025, outpacing a modest 1.5% increase in NM-MT 8 prices and an outright decline of 3.2% for those carrying a Mint 9 designation. Raw, ungraded cards have yet to regain the all-time index high of 435 that was reached at the absolute height of the set’s popularity in 1997.

The top 10 cards in the checklist represented a larger proportion of overall set value in 2025 compared to prior years. This continues a multidecade trend in which a handful of cards represent a growing share of the cost of completing the set. 10 cards once again account for roughly 50% of the set’s value, a level last seen in 2022.

This upward swing for the biggest names was most pronounced among ungraded cards, which experienced a 21.6% increase in prices for the 10 most in demand cards over the prior year period. Slabbed 8 and 9 cards experienced more muted gains of 4.3% and 1.5%, respectively, figures that outpaced overall Y/Y changes in set pricing.

Ken Griffey, Jr. reclaimed the title of most coveted Refractor from Nolan Ryan, though for all intents the pair dominate the checklist and are essentially interchangeable. The Ryan card trades less often and is subject to wider price swings than Griffey. Greg Maddux, Mike Piazza, and David Justice are new to this year’s Top 10 ranking, replacing Bernie Williams, Don Mattingly, and Lance Johnson.

Turning to the opposite end of the spectrum, the set’s common cards can tell a story as well. Shown above are the average values over time of all cards ranked by value in the bottom third of the checklist. At this level you do not get any scarcity premiums affecting values, only the overall demand for less popular cards. The standout observation in recent history is the price action of commons graded NM-MT 8, which over the past two years have climbed across the board well above historical trends.

POTENTIAL NEW METRICS

I am working on two statistical models that should prove useful in the future. The first attempts to assign a “scarcity index” to each name in the checklist, taking into account multiple factors reflecting just how easy or difficult obtaining any particular card can be. The second model aims to identify cards exhibiting the data signatures of a collector hoarding a specific name. Unfortunately, these models are not yet ready for publication and I do not want to keep pushing this update back any further. I will continue to sporadically return to their development and hope to have further news in a future installment of this report.

WRAPPING UP 2025

Once again, I hope this review proves useful for fellow collectors interested in pursuing building a set of their own Refractors. I continue to gather information and will be back again next January with the next update. In the interim, I would love to take a look at any other set collectors (regardless of collecting focus) who undertake similar work for their projects. Let me know when you find something that fits.

Methodology questions? A guide has been set up here to provide the rationale and address some questions that may arise.