Topps captivated me with the release of its 199-card Finest baseball card set in 1993. I have spent several years building a full set of the refractor version of these cards and finally completed this goal in 2024. I chased down every name in the checklist, but more than that I chased down every scrap of information I could find about these cards. When I started there wasn’t a central source of information that I could tap to gain a quick understanding of the set. Which names were the hardest to find? Which ones were more condition sensitive than others? Were the remnants of information and anecdotes left on deprecating message boards still accurate? How were underlying hobby currents shifting the answers to these questions from year to year?

From the beginning of my set building journey I began compiling data to answer just these sorts of questions. A couple years ago I began publishing limited information quarterly in a graphical format as the “Refractor Dashboard” here on CardBoredom. Work continued behind the scenes to improve data collection and tease out better insights. This has progressed to a point where I want to formalize my findings beyond what appears in the dashboard. What follows is a more in depth look at the ’93 Finest Refractor set incorporating availability, grading trends, and even pricing models. I plan to revisit this report on an annual basis, updating it with the latest information and drawing conclusions about what changes may be in store for those, like me, who so tirelessly chase after its components. What I wanted to create was the resource I wish had existed to help me build the set. What follows is my attempt to create and share just such a resource.

NEW IN 2024

What is old is new again, at least when it comes to Topps Finest and Refractors. The 2024 edition of Finest hit hobby shelves in August. Tucked inside some of the metallic packaging were a pair of insert sets partially based on the original 1993 release. Dubbed “What If…1993 Prototypes,” the cards make use of a 1993-inspired “Baseball’s Finest” banner at the top of the cards. These were produced in a 25 card checklist and again as a smaller 16 card version featuring player autographs on every card. While the backs look very much like the ’93 Finest set, not much else shows a visual link to the original. I get the feeling these cards are going to end up looking more like 2025 Topps flagship rather than 1993 Finest.

What these checklists do provide is a range of refractor parallels to chase. The larger set features the familiar multicolor refractor treatment, as well as 7 different single color versions with increasing rarity alongside a 1:1 superfractor edition.

This is not to say there wasn’t some fun to be had with the original ’93s during the Year of Shohei Ohtani. I found 36 instances in 2024 of collectors picking up ’93 refractors at single-digit prices. Lower grade slabs were a fruitful way of adding cards on a budget. Several PSA 6 commons changed hands at prices below $10, as did a large number of cards labeled only as “Authentic” by CGC. The steal of the year belongs to the nameless individuals who added Cecil Fielder for $6.75 and Juan Guzman to their collections for less than $3. Three bucks for a refractor!

At the other end of the spectrum we reached the first post-COVID hobby year in which a ’93 Refractor did NOT crack the $10,000 mark. The biggest 2024 sale was for a PSA 9 Ken Griffey, Jr. that went for $7,669.69 (Nice).

While I did not see any refractors in the wild at the three card shows I attended, there was some movement observed in cards previously considered to be in short supply. Two years ago a hoard of Jimmy Key cards was broken up. In 2024 the card, at least in lower grades, finally became just as plentiful as any other card and traded at prices that no longer reflected the frustrating shortage that dogged set builders for years.

This fall I heard from another collector building a set and as of our last contact he is just three cards away from completing the project. He has plans for an awesome display that I definitely want to see pictures of.

AVAILABILITY

How readily can 1993 Finest Refractors be obtained? Is it as easy as clicking a button?

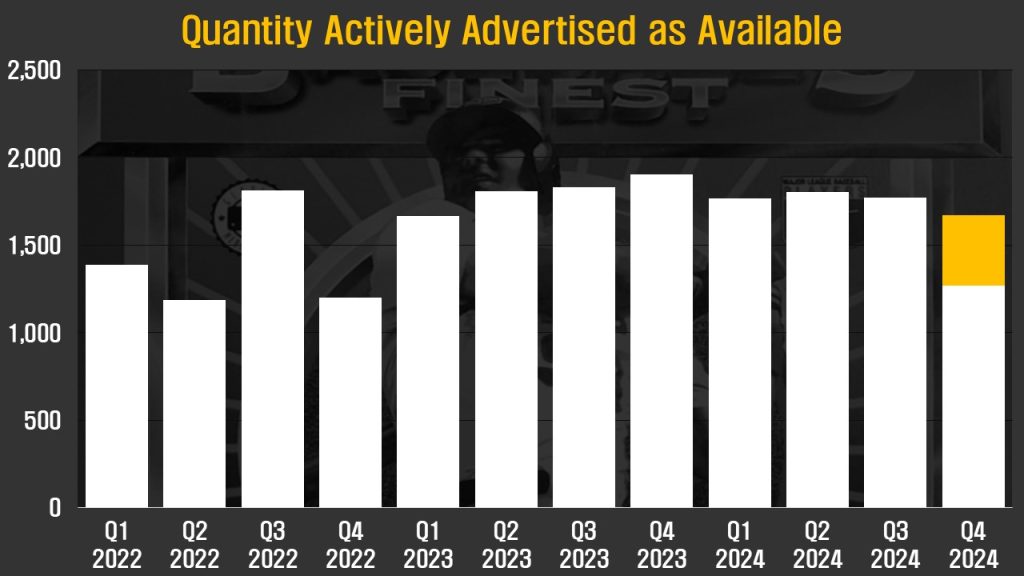

The past several years have not seen a material change in the number of refractors on offer at any given moment. From looking at the major hobby sales platforms there were 1,669 refractors either listed for sale or in the process of being actively auctioned off on the final day of 2024. Of this amount there were 1,271 cards offered individually or in small lots. The remaining 398 card balance consisted of two full sets, shown in amber in the graph below. These sets have been advertised for two years and are possibly a single set cross listed with different pictures across sales platforms.

One limitation of this view is that it only reflects advertisements for cards regardless of asking price. A card offered for sale with a ridiculous asking price is just about as good as not being available in the first place. What we are after is a reflection of how often a buyer and seller can expect to actually connect and complete a transaction.

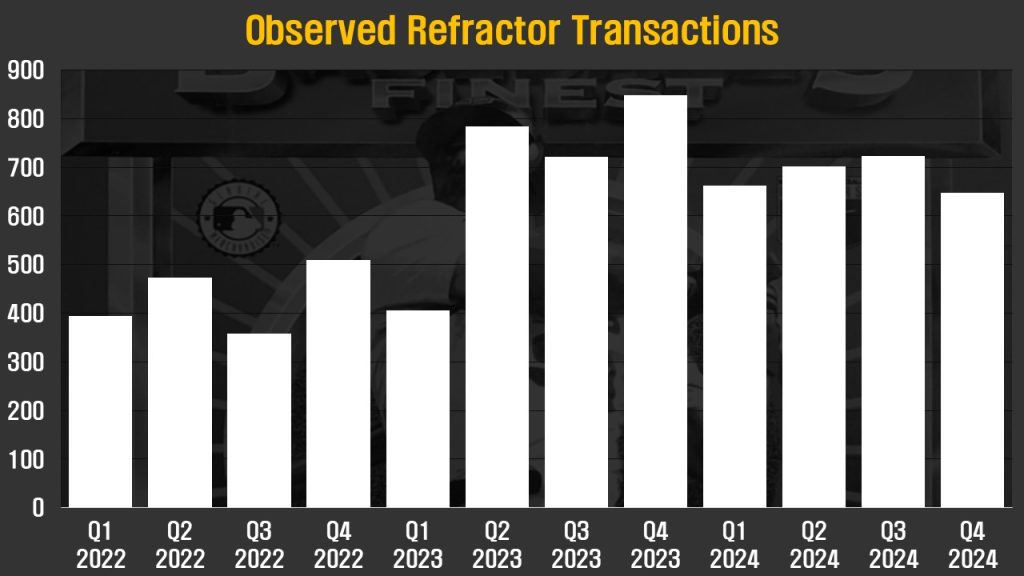

In 2024 I observed transactions covering 2,735 refractors, down 1% from the 2,760 seen in 2023. The number of cards seen changing hands in 2023-2024 showed little change but represents an annual increase of almost 1,000 cards from 2022. This overstates the scale of increased transaction volume from 2022 to 2023 as I began incorporating more data sources into my transaction database around this time. A portion of the increase can also be traced to the late 2022 breakup of several complete sets, many cards of which were then sold individually to recoup some of the purchasers’ costs or to seek a profit.

In the end, 2024 looked a lot like 2023 in terms of the overall number of cards changing hands. What about the availability of individual names within the set? This is of particular interest to collectors given perceived scarcity accompanying portions of the checklist.

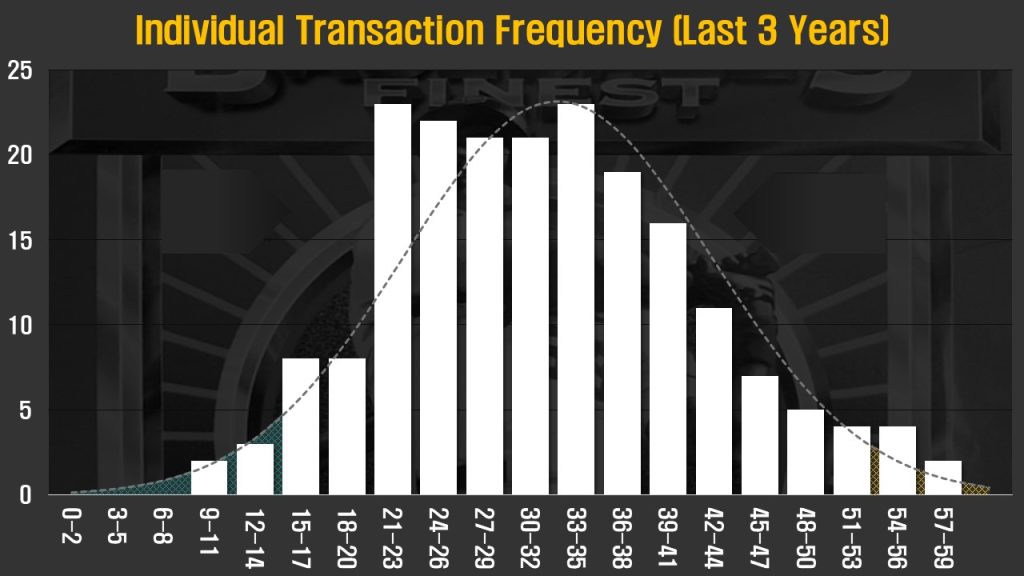

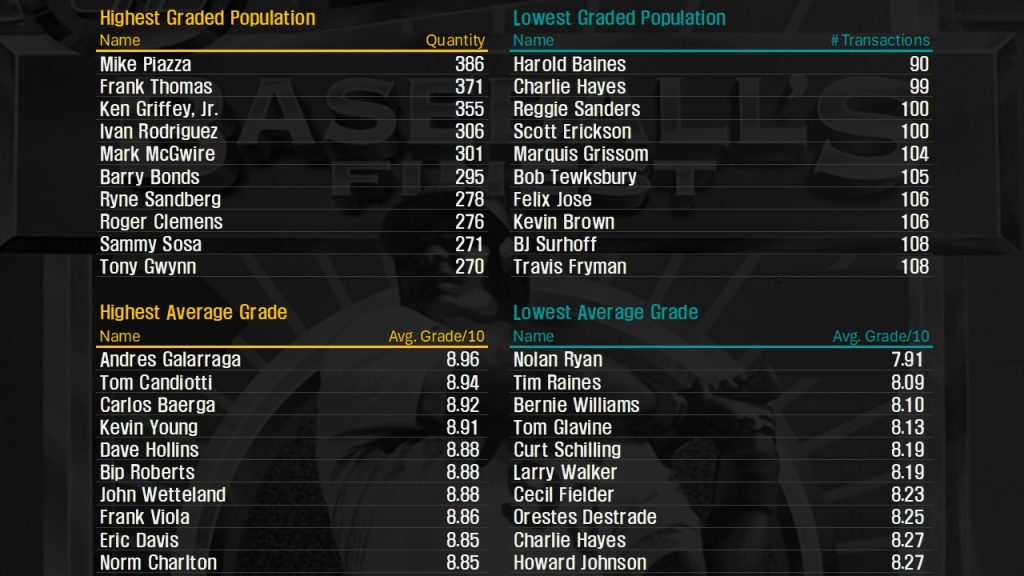

Appearing below is a histogram of how often each card in the checklist was observed being bought or sold over the past three years. The X-Axis represents the number of transactions recorded for each card while the Y-Axis displays the quantity of names in the checklist falling within that range of transactions. Cards of Ken Griffey, Jr. and Joe Carter were each sold 59 times during this period while those of Rickey Henderson and Ivan Rodriguez were only seen 10 times inside the 36 months. These four cards inhabit the columns at the left and right tails of the distribution with the other 195 names in the checklist falling somewhere in the middle. The average refractor experienced 32 sales in the same 36 months, indicating a typical card from the set becomes available about once every 5 weeks.

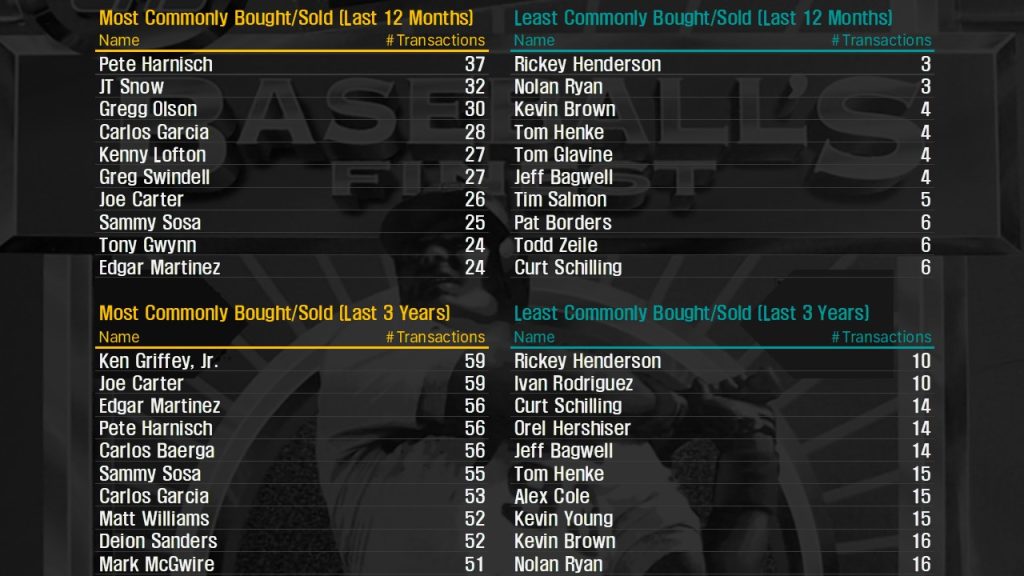

The tables below lay out the 10 most and least commonly transacted refractors over the previous 1 and 3 year periods. Many of the cards most often changing hands are connected to distribution of large collections of the same card. Dozens of Carlos Baerga and Carlos Garcia cards were sold by a (probably unrelated) pair of collectors in recent years. A similar surge of newly available Pete Harnisch cards in 2024 is indicative of another mini-hoard being broken up, though unlike the others this card appears to have the same buyer snapping up most of the ones coming to market. Deion Sanders cards have seen above average interest in the past 3 years with his high profile approach to college recruiting.

Rickey Henderson and Nolan Ryan, both players with dedicated collecting bases of their own, were the least seen refractors in 2024. This continues a similar level of market scarcity as both cards are also counted among the refractors least seen over the past 36 months. In fact, more than half of the least seen cards of 2024 rank among the least visible of the prior 3 years.

During the last 12 months a Pete Harnisch card was sold on average every 10 days. In contrast, the least seen cards averaged one sale about every 120 days. As of the end of 2024 the cards of Duane Ward and Reggie Sanders have gone the longest without a recorded sale, both at 122 days.

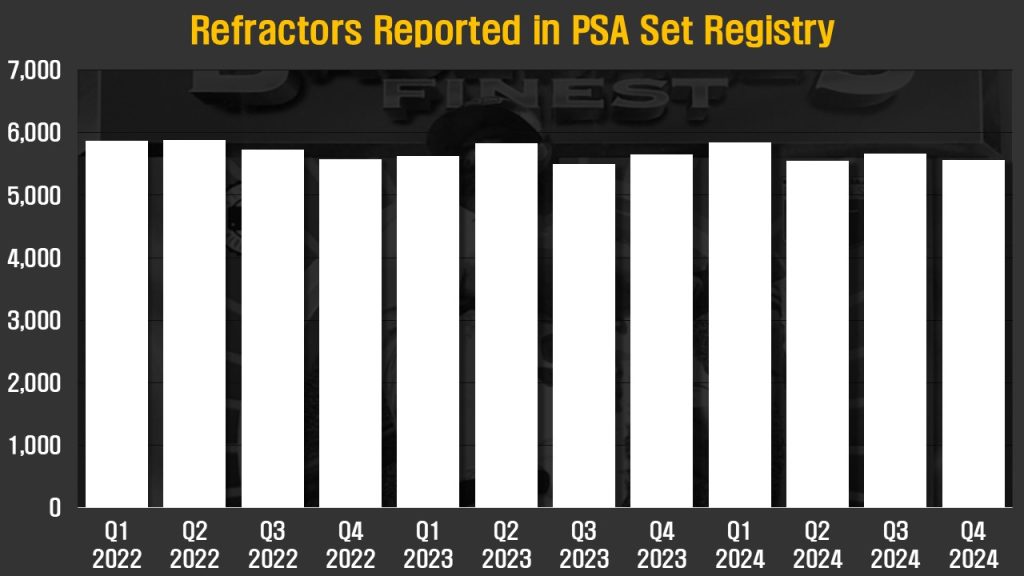

Another way of gauging availability trends is to look at the opposite of advertised and sold cards; the absence of transactions that represent the number of cards locked away in long term collections. While no publicly available figure provides a direct insight into how many cards will be unavailable for an extended period, there exists a somewhat reasonable proxy. Multiple refractor collections are recorded within the PSA Set Registry. Many registry participants have been involved with building the set for extended periods. Combined with the fact that the registry does not allow for duplication of individual serial numbers, this census presents a relatively clean data set and likely reflects a general correlation with the number of cards unlikely to be offered in the near term.

The total refractor registry population declined 2% from the year ago period, in line with the periodic low single-digit volatility seen across the last five years. Registry sets contain 20% of all refractors graded by PSA.

GRADING

The first refractors announced the end of the Junk Wax Era and ushered in the era of shiny parallels and manufactured scarcity that would follow. Also coming into their own at the same time were third party grading services and comparative set registries. The concurrent rise of these trends led to many refractors being slabbed in the late 1990s and early 2000s.

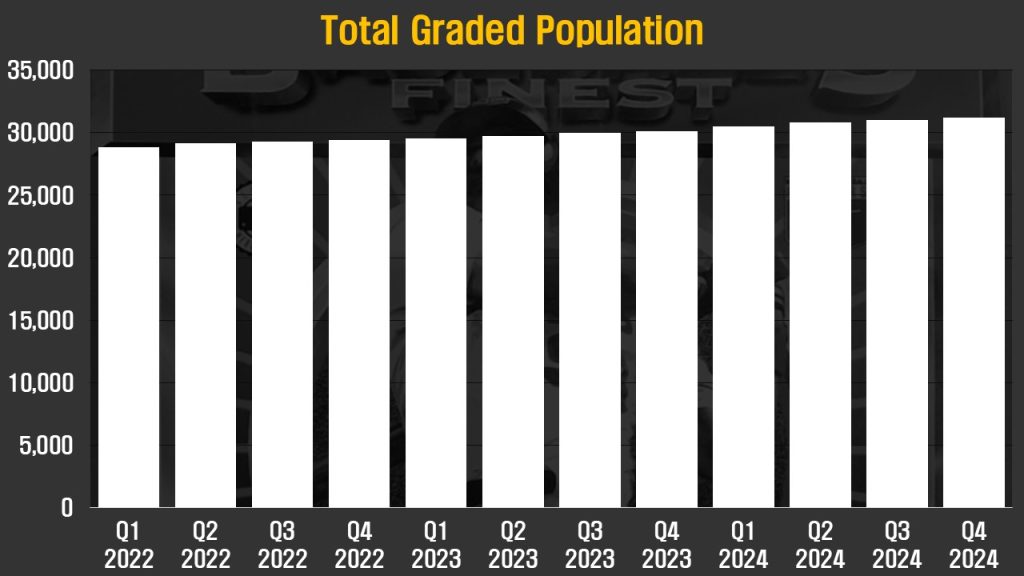

The last five years of the hobby have witnessed a massive expansion of the use of third party grading. PSA graded 15 million cards in 2024, up from an annual pace of 2 million in 2019. Despite this surge in grading interest and a flood of overproduction era cards entering grading queues the number of graded refractors has seen only marginal growth.

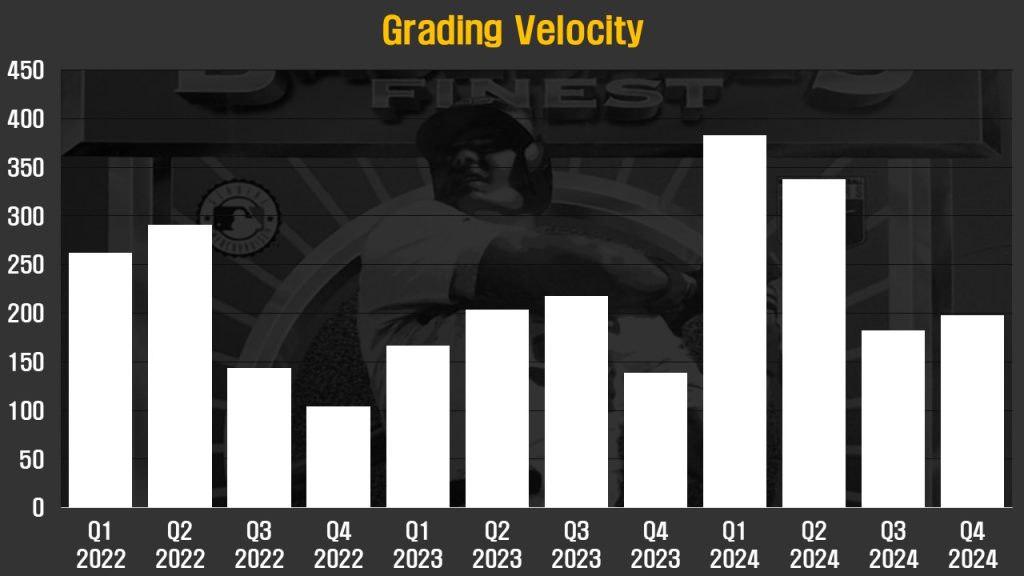

Breaking down grading trends further, one can see the number of graded ’93 refractors increasing by 1,101 cards in 2024 and a similar pace in prior years. This represents annual population growth of about 3%, a figure indicative of many cards in the print run having already been slabbed.

Two of the net 1,101 cards slabbed in the previous 12 months achieved Gem Mint 10 designations. PSA affixed this designation to cards of pitchers Alex Fernandez and Doug Drabek. In a rarely seen move, a PSA 10 John Kruk was removed from the population report during the same period.

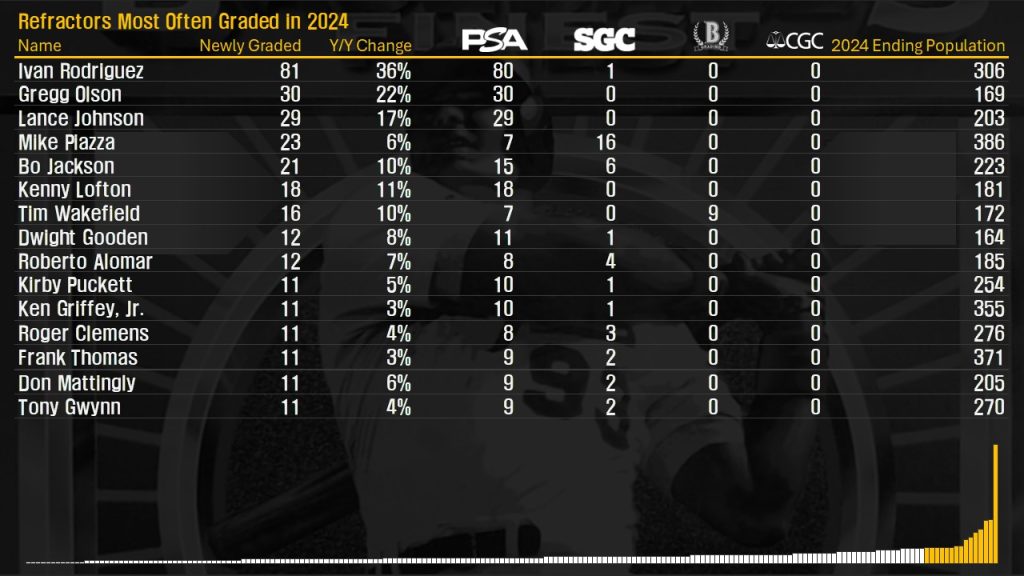

Close to half of all refractors made have been reviewed by the four major grading services with PSA accounting for 90% of the total seen to date. Beckett and SGC hold almost equal shares of the remainder, though the past year has seen SGC capture an outsized share of grading newly submitted refractors at the expense of its similarly sized rival. This trend is projected to intensify in 2025 with collectors stepping back to assess a challenging governance situation at Beckett’s corporate parent. CGC experienced a small inflow of cards in 2024 but has a negligible presence within the set with many of the new CGC arrivals having been submitted for authentication rather than grading.

The typical slabbed ’93 Finest Refractor has a numerical grade just above NM-MT+ 8.5. With so few cards being newly graded the overall condition profile of the checklist sees very little change from year to year.

Of the 1,101 cards graded in 2024, an astounding 81 featured Ivan Rodriguez. This was enough to increase the graded population of Pudge cards into the Top 5 most graded names. This is unlikely to be the result of random chance among grading submissions. Rodriguez has a collector who has spent a lengthy amount of time accumulating his refractors and given the low print run my guess is the majority of these newly graded cards are from this person’s collection.

Could these cards be coming to market soon? If so, it could ease the lengthy shortage that has plagued collectors looking for this card. PSA charges progressively higher grading fees for cards valued above $500, making the cost of slabbing so many cards somewhere on the order of $5,000. Such a financial barrier makes it a rather expensive undertaking for someone not looking to eventually move the cards.

Also of interest among these recently graded names are Lance Johnson and Gregg Olson. Both cards have seen strong interest from a pair of collectors thought to be chasing multiple copies of specific cards. Both names experienced a price surge in 2024 as supply and demand collided. Previously considered commons within the checklist, the increased attention has prompted an influx of raw cards to be graded in order to assuage prospective buyers prior to being offered for sale.

PRICING TRENDS

When the idea of collecting the entire ’93 Refractor set first came to me, I referenced PSA’s SMR price guide to gauge the scope of the emerging project. At that time the guide showed a good number of Hall of Famers could be had for $50 in my targeted NM-MT condition with many upper tier names not too far above the century mark. I moved forward, assuming the whole set could be wrapped up in 8 years with a monthly budget of $100 or so.

That worked flawlessly until I actually tried to buy some cards. I quickly discovered both online and print price guides were woefully out of touch with the market. I was soon flying blind, not sure of which cards were overpriced and which were genuinely reflecting scarcity in their sticker numbers. I needed to come up with my own framework for setting pricing expectations if I was to have any hope of building the set. I began gathering every transaction record I could, eventually expanding my database to incorporate more than 40,000 transactions from this 199-card set.

Last year I captured transactions covering more than 2,700 refractors and $469,937 in sales volume, enough to provide a solid backdrop for building models encompassing the most commonly encountered grades. I manually reviewed all the datapoints making their way into my records, removing each and every item that would trip up the pricing models used by the large, scalable online pricing services. It was a lot of work, but in the end I wound up with a very clean data set and output that I could trust.

Here is what I found:

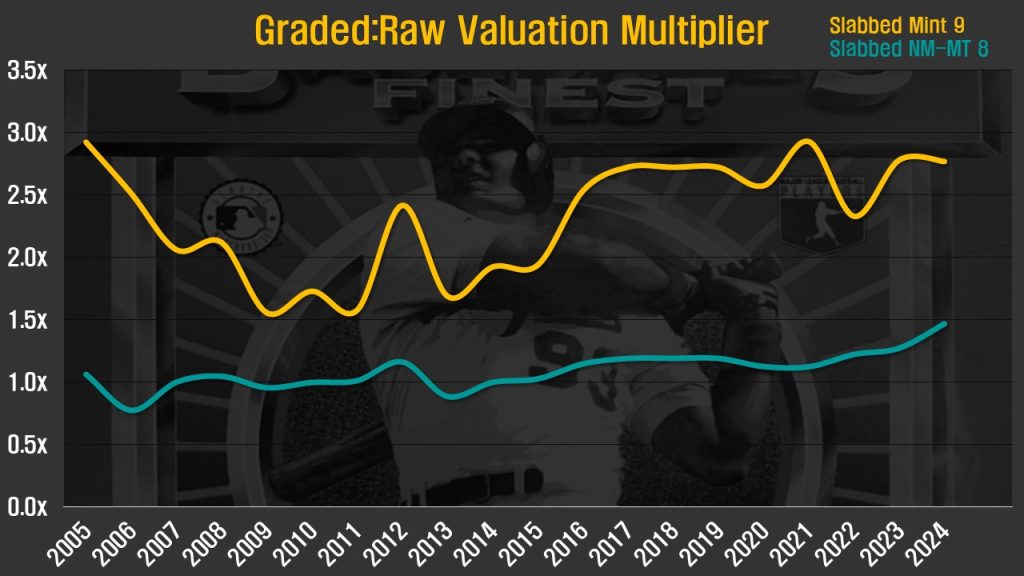

For starters, some sort of relative pricing structure was needed in order to properly scale expectations higher or lower depending on a card’s grade. A raw card is always a raw card, but how much of a premium or discount should be applied for a slabbed NM-MT copy? It turns out cards in this grade were priced by the hobby at a level roughly equal to raw examples until just a few years ago. The price at which NM-MT cards changed hands had grown to a 27% premium over non-slabbed cards in 2023 and expanded further to a 47% premium in 2024. Cards identified as Mint 9 by the major grading services saw no change in condition premium in 2024 and have largely held steady at ~2.75x their raw counterparts since 2017.

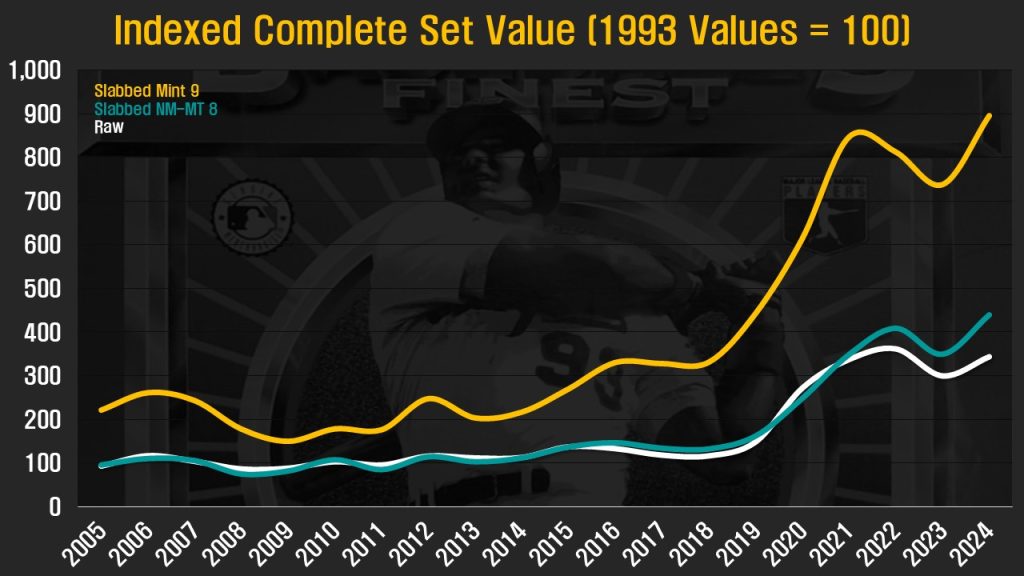

The historical near 1:1 relationship between ungraded and slabbed NM-MT cards can be seen in the 20 year history of complete set values below. Prices are presented on an indexed scale with a starting value of 100 representing the first Beckett pricing of the cards in 1993. Prices for raw cards increased by an average of 14.6% in 2024. Expanding condition premiums on top of this price trend translated into 25.7% and 21.4% increases for slabbed NM-MT 8 and Mint 9 cards, respectively.

The all-time high for an ungraded set was reached in 1997 with an indexed value of 435. Despite the recent runup in prices this implies a more than 20% loss in value from the high point 27 years ago.

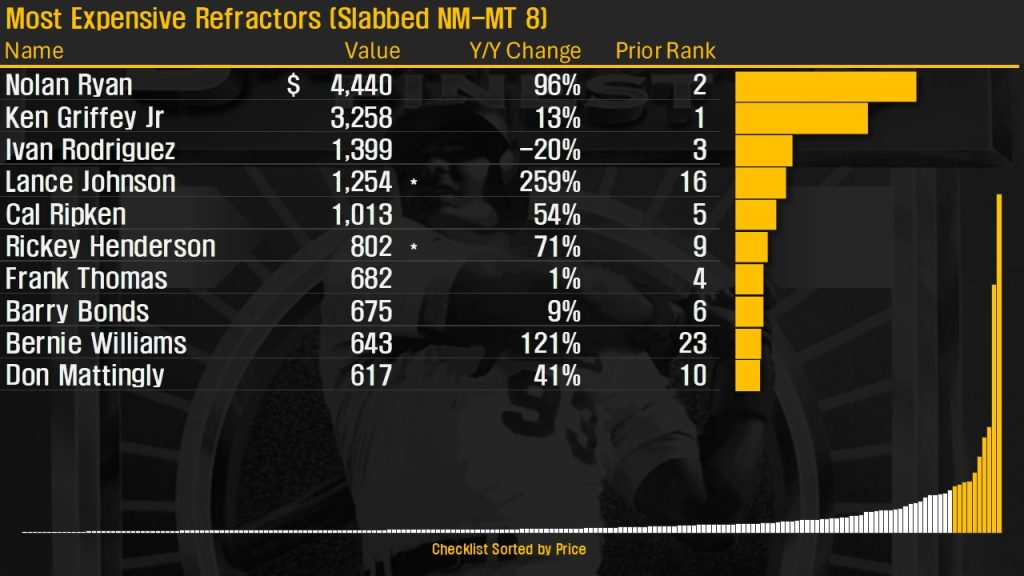

It was not just a handful of cards driving price movement in 2024. The 10 most valuable cards represented 42.8% of overall set value at year end compared to a similar level of 41.2% in 2023. Graded cards exhibit a slightly higher concentration among the top 10 but not by a material amount (NM-MT 8 = 43%; Mint 9 = 46%). These cards can be seen in the amber portion of the exhibit below.

The names that constitute the top 10 are largely stable from year to year as the players depicted have been long retired from the game. There are, however, generally a small number of cards dropping in and out based on shifting condition premiums and perceptions of relative scarcity. The premium for super-collected Lance Johnson cards took off, taking the pedestal held several years earlier by Orel Hershiser as the most difficult low/middle tier player to obtain. Dropping out of the top 10 in the last 12 months were cards of Greg Maddux and Mike Piazza.

WRAPPING UP 2024

I hope this review proves useful for fellow collectors with an appreciation for these cards. I’ll be back next year with another update encompassing developments taking place in 2025. Hopefully I can find additional sources and further expand the scope of what is covered. I’m happy to take a look at any other set collectors (regardless of collecting focus) who undertake similar work for their projects. Let me know when you find something that fits.

Methodology questions? A guide has been set up here to provide the rationale and address some questions that may arise.